The Vox Vacation Index: let economics help plan your summer vacation

For our honeymoon, my wife and I (Tim) went to Argentina. There were a number of reasons the country attracted us — gorgeous architecture, delicious wine and steaks — but one important factor was the exchange rate. In the year before our 2009 trip, the Argentine peso had lost more than 15 percent of its value, meaning that we could expect bargains on almost everything we bought.

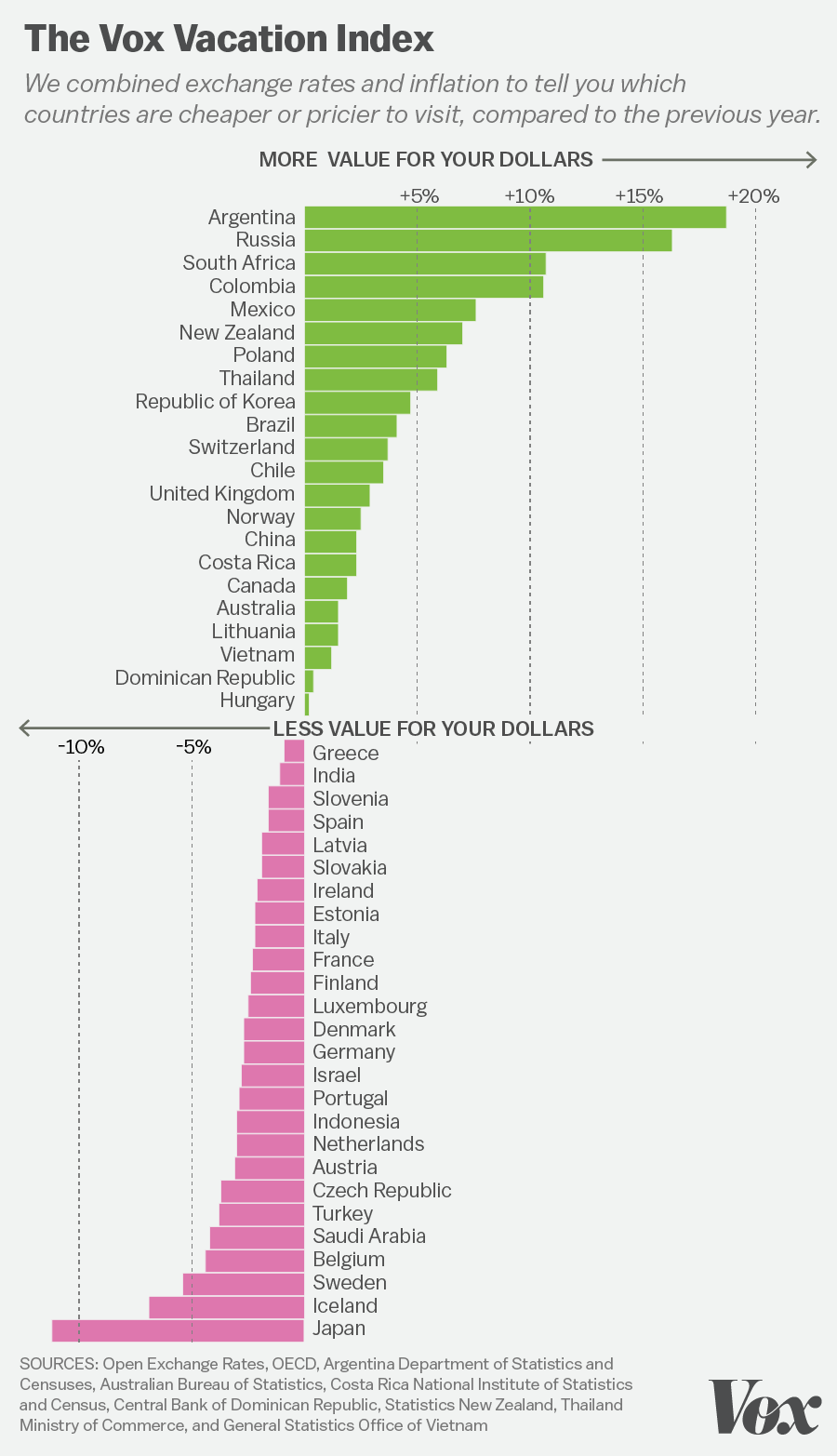

But finding a great macroeconomic bargain is about more than simply looking up exchange rates. Currency depreciation often leads to inflation — higher prices — in which case your dollars might buy more pesos (or yen or euros or what have you) without actually buying you more steak. That’s why we created the Vox Vacation Index, which combines exchange rate and inflation information to tell you which countries are getting cheaper to visit:

The graph shows which countries are a relative bargain now

In absolute terms, of course, a poor country with low wages is almost always going to be cheaper than a country with high living standards. So in basic cheapskate terms, the right play simply is avoid Europe and Japan and travel instead to a country with a low standard of living, like India or Vietnam.

In contrast, our vacation guide assumes that you’re going to want to visit different kinds of places over the course of your life. Maybe you’d like to eventually make it to Paris, Rio de Janeiro, Shanghai, and Bangkok. This map shows the countries that are offering an unusually good deal right now. Not “is France cheap?” but “is France cheaper than it was a year ago?”

To answer this question, we combine two different pieces of data: the change in the exchange rate and the local inflation rate. For example, right now, one US dollar will buy about 14.2 South African rand — 18 percent more than the 12 rand you could get in April 2015. But the inflation rate in South Africa has been about 6.6 percent, so today’s rand won’t go quite as far as it would have a year ago. But even adjusting for inflation, a dollar will buy 10.7 percent more goods in South African than it would have a year ago.

Right now, the countries where the dollar has seen the biggest gains over the last year are Argentina, Russia, Colombia, South Africa, and Mexico. So if you’re planning a vacation this summer and have been thinking about visiting any of these destinations, this could be a great year to do it.

On the other hand, Japan and Iceland have seen their currencies strengthen against the US dollar over the last year. So if you’ve always wanted to visit Japan, you might want to wait another year or two.

You can see our list of 48 countries above, with the best deals at the top — and we’ve also created a map that shows where in the world the relative bargains are right now.

Tourism dollars help countries with weak currencies

You might notice that the countries topping our list of vacation bargains tend to be countries that are going through challenging economic times.

Russia’s economy is heavily dependent on oil, and so plunging oil prices have dragged down the value of the ruble. South Africa’s rand plunged last December after the country’s government ousted a widely respected finance minister.

The Argentine peso also plunged 30 percent last December after Argentina’s new president removed capital controls that had been propping the peso up. This was part of a broader package of economic reforms designed to aid in recovery from the economic mess created by the president’s predecessors.

So it might feel wrong to travel to countries with weak currencies — like you’re profiting from the misery of others. In a sense, you are. But you shouldn’t feel bad about it — by visiting you are helping to solve the problem.

Countries benefit when tourists visit and spend money. And countries need the most help during periods of economic hardship. Often, an economic downturn means that the locals are spending less money on hotels, restaurants, and other services. A flood of American tourists helps to offset these losses in industries that tend to go through big boom-and-bust cycles.

So enjoy vacation bargain-hunting with a clean conscience.

Notes on methodology: Exchange rates are from May 2, 2016, and May 2, 2015. Most inflation figures are for the year ending in March, the most recent month available from the OECD. We use April inflation figures for Belgium and Iceland. Argentina’s inflation rate is based on consumer prices in Buenos Aires because the government isn’t currently publishing a reliable national inflation rate.

Leave a Reply